For many, it’s the most wonderful time of the year, and the season starts earlier and earlier each year. Just like Christmas Creep, we’ve seen an even more concerning trend in retail: Returns Creep.

Despite the disruption our industry has experienced over the last year and a half, the American shopper has shown little signs of slowing down: They have just changed buying channels. The shift to online shopping has greatly accelerated the returns crisis. Roughly a third of 2022's product returns will happen between the months of October to January.

Is your organization prepared to process the influx of returns, and address the upstream issues that cause them?

Has National Returns Day Become Returns Season?

In 2016, UPS declared January 5th as National Returns Day—the day when the most packages are sent back to retailers. Since then: returns have steadily increased and become more dispersed throughout the season. In 2018, National Returns Day happened on the 19th - a full six days before Christmas, and that was before our whole industry was flipped on its head by a global pandemic—driving customers to digital channels to purchase and resulting in a significant spike in return activity: Last year, National Returns Day became National Returns Week.

Consumer surveys are showing that almost a quarter of shoppers plan to shop well before the holiday this year. The majority—57%—are planning to make the bulk of their purchases online.

This, coupled with Christmas Creep, means that National Returns Week is stretching out to become a National Returns Season.

The Perfect Storm of Holiday

The returns process is more omnichannel than it has ever been.

With the proliferation of online shopping, BORIS—or Buy Online Return in Store—drives more customers to physical stores and provides opportunities to not only convert returns into exchanges but increase sales.

Retailers are reckoning with labor shortages at the same time as they are dealing with the operational challenges associated with creating a seamless omnichannel experience. This requires retailers to do more with much less.

Hear from Ulta’s former CIO, Diane Randolph, on how returns impact peak season:

Inventory Optimization will be a key competitive advantage for retailers.

Supply chains are a long way from recovering, resulting in higher prices, longer wait times, and in many cases, empty shelves, putting retailers in very fragile positions. Retailers have an excess of stock that has little demand, and analysts predict a potential surge of retail bankruptcies ahead.

Inventory visibility could make or break this holiday sales season for many.

In situations where consumer demand outweighs supply, having visibility into last year's top-performing products—not just the products that sold, but the products that were kept—can be a significant asset as you project for holiday and beyond.

Another possibility: What if returns were considered part of a retailer’s sellable inventory while they were being processed? By having visibility into returns as they are coming back, whether in-store or online, retailers can strategize how to best fulfill orders, whether it’s to ship the item from stores or re-direct returns to a particular distribution center.

Newmine’s Chief Returns Officer platform has a module specifically designed for this, called Advanced Returns Insights (ARI).

Using advanced return notification data, ARI takes unstructured, raw data and provides retailers with the earliest insights on their returns—empowering inventory, planning, DC ops, and customer service with enhanced visibility into returns from the moment the 3rd party returns shipping label is printed. With this information, retailers can anticipate returns volume and plan a re-merchandising strategy for the products that are being returned.

How Can Retailers Prepare For The Returns Flurry Now?

Here’s your opportunity to turn your data into a gold mine. The increased volume of sales and returns during the holiday creates a strong opportunity for retailers looking to focus more on data-driven insights to optimize their business. Returns are a retailer’s best beacon for understanding their product quality and supply chain performance.

A recent study by Incisiv found that 73% of returns occur due to retailer-controllable action, or inaction.

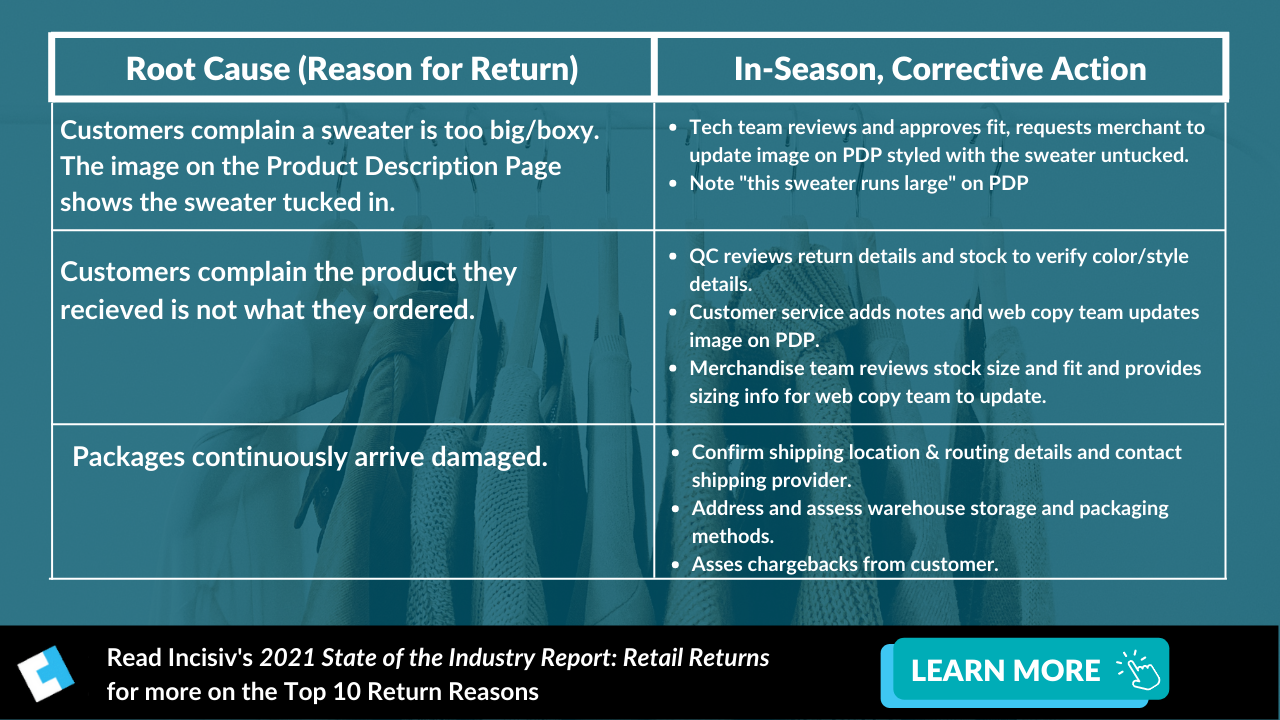

Consider the following return root causes and their corresponding corrective actions:

The challenge most retailers have is identifying these root causes in time to take action, which is why many forward-thinking retailers are instituting Returns Reduction initiatives and making investments in the cutting-edge technology that can perform the analysis for them. If you perform analysis after the season, you’re missing the chance to correct issues in real time, reduce/avoid returns, and develop benchmarks in 2023.

Returns Creep can’t be completely avoided around holidays. But with a sound strategy and a positive perspective, retailers can turn Returns Season into their most insight-rich time of year.